Client Data Intelligence for Financial Advisors

Gather client documents and make sense of them — fast.

- Smart checklists

- Branded client portal

- Client-ready reports

- Extract data from any document

- Push data to any system

Trusted by fast-growing advisory firms

Mokan Wealth

Mokan Wealth  Foundry Financial

Foundry Financial  Everest Private Wealth

Everest Private Wealth  Beyond Balanced

Beyond Balanced  Partner PF

Partner PF  Earn Into Wealth

Earn Into Wealth  Minerva Planning Group

Minerva Planning Group  Trinity Wealth

Trinity Wealth  Windjammer Wealth

Windjammer Wealth  Maridea Wealth

Maridea Wealth  Meyers Money

Meyers Money  K2 Wealth

K2 Wealth  Bellwether Wealth

Bellwether Wealth  The Planners

The Planners  FFPlan

FFPlan  Intentionalize

Intentionalize  Mokan Wealth

Mokan Wealth  Foundry Financial

Foundry Financial  Everest Private Wealth

Everest Private Wealth  Beyond Balanced

Beyond Balanced  Partner PF

Partner PF  Earn Into Wealth

Earn Into Wealth  Minerva Planning Group

Minerva Planning Group  Trinity Wealth

Trinity Wealth  Windjammer Wealth

Windjammer Wealth  Maridea Wealth

Maridea Wealth  Meyers Money

Meyers Money  K2 Wealth

K2 Wealth  Bellwether Wealth

Bellwether Wealth  The Planners

The Planners  FFPlan

FFPlan  Intentionalize

Intentionalize Financial Planning Takes Weeks of Prep Work

Great financial advice requires complete, accurate data. But gathering documents, entering data, and keeping everything current consumes hours that should go to planning.

Weeks of Document Chasing

New client onboarding stalls while you wait for tax returns, statements, and policies. Every missing document delays the plan.

Hours of Manual Entry

Typing data from statements into planning software takes hours per client—time better spent talking to clients.

Data That's Always Outdated

By the time you've entered everything, circumstances have changed. Keeping the picture current is a never-ending battle.

Build a Complete Client Picture in Days

Flextract automates document collection, data extraction, and organization—so your team can start planning faster and keep client data current.

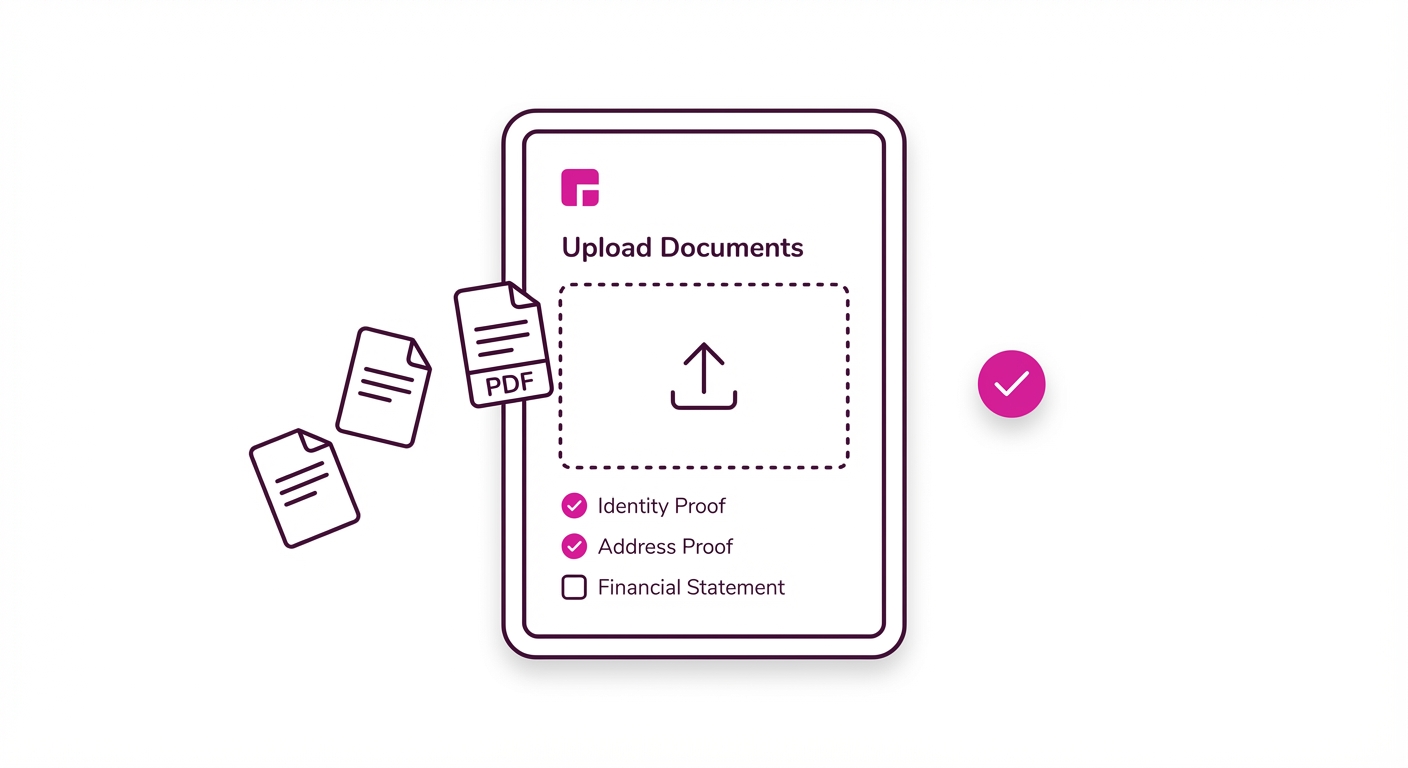

Gather

Collect documents with Smart Checklists. Share a branded portal with clients. Match uploads automatically.

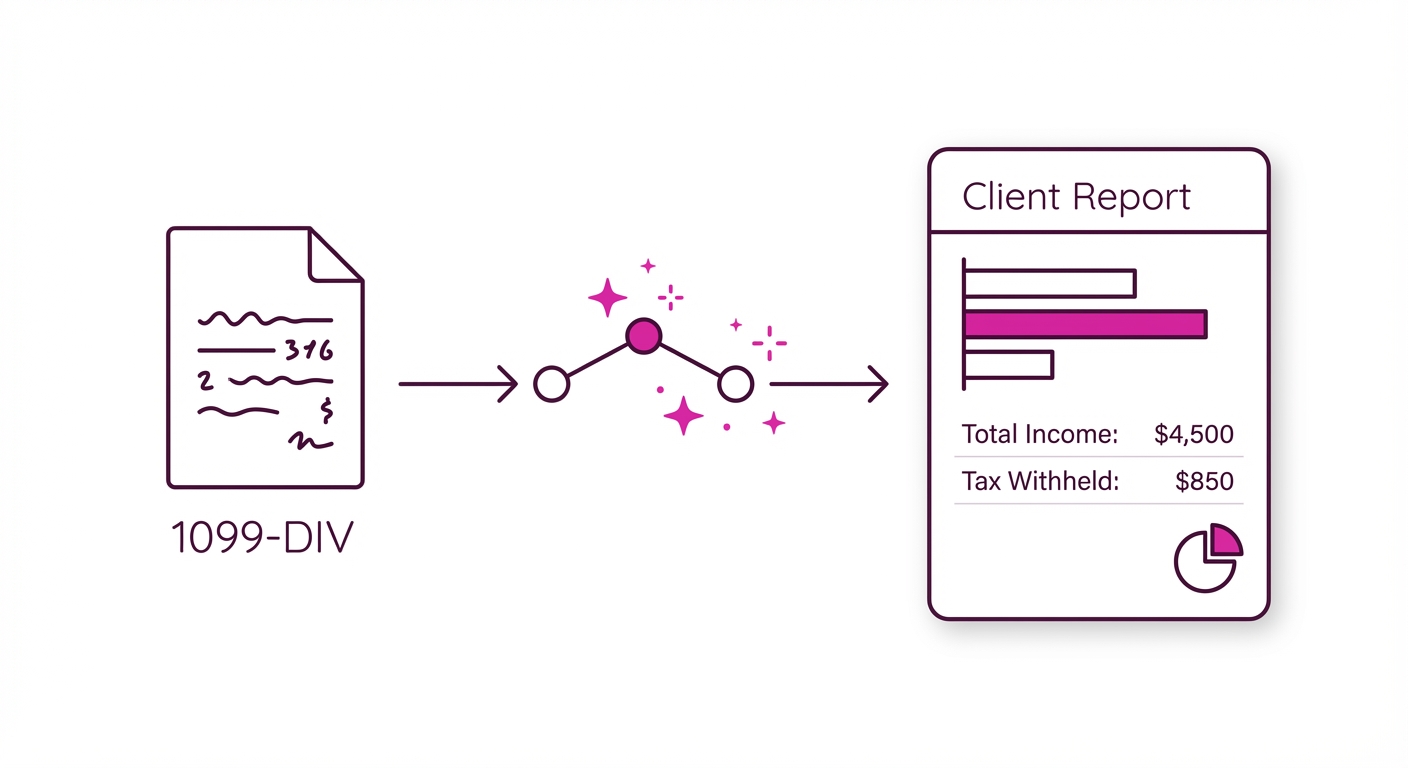

Analyze

Our AI reads and extracts data in seconds. Generate reports. Ask questions with Deep Dive.

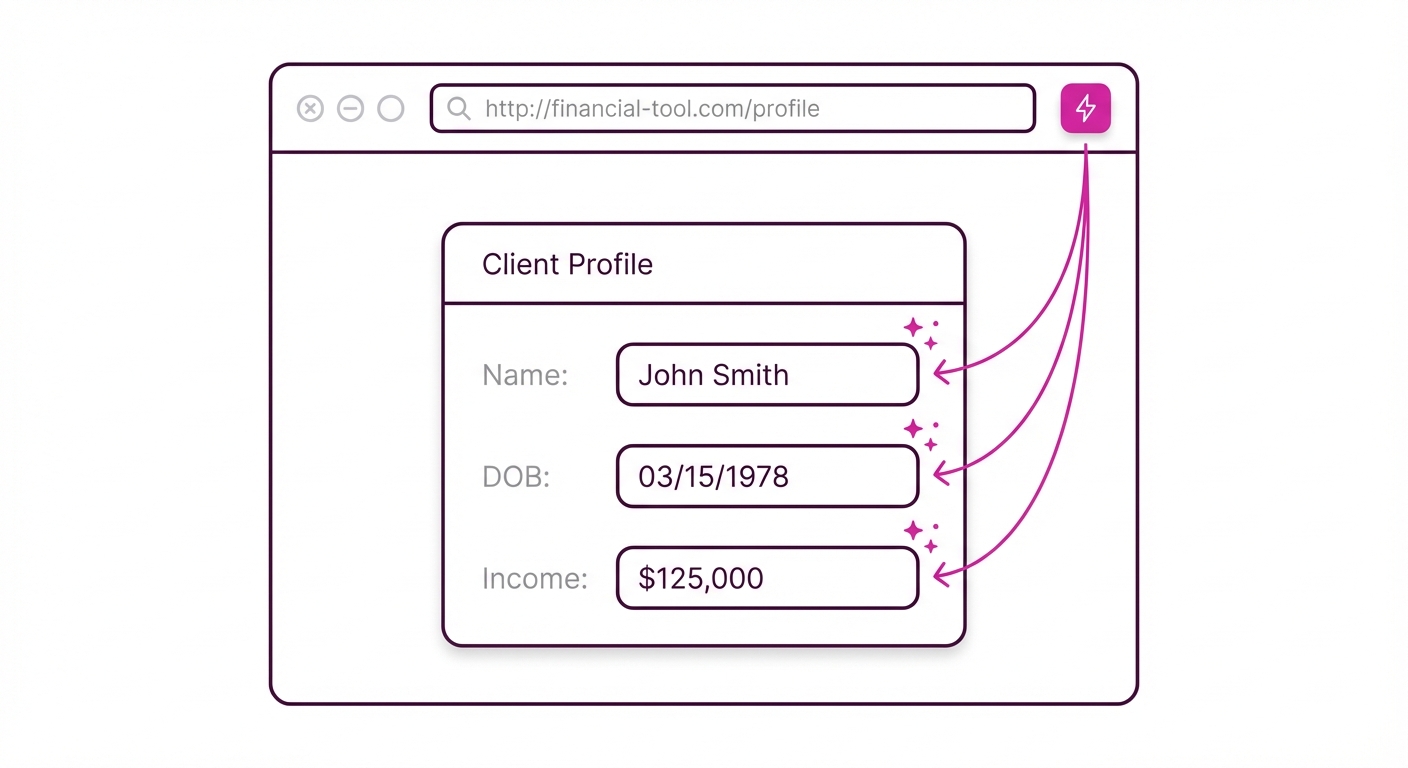

Integrate

Use the Chrome Extension to bring extracted data into any web-based tool.

More Time for Advice, Less Time on Admin

When the busywork disappears, planning teams get back to what they do best—delivering great advice.

"If there were ways that we could, instead of making that a three to six hour process, could make that a two and a half hour process. And you do that a hundred times, well, you just save 250 hours."

"You just jump to value so much quicker. This is solving a pain point that no one's solving."

"The simplicity is key. Client experience is the main thing."

See Flextract in Action

Take an interactive tour to see how planning teams use Flextract to build complete client pictures faster.

Simple Pricing

No per-seat fees. No complex math. Just pay for the clients you serve.

Enterprise Security. Personal Service.

SOC2 Type II Compliant

Independently audited security controls

End-to-End Encryption

256-bit AES encryption at rest and in transit

Enterprise AI Models

Your data is never used to train AI models

US-Based Support

Real humans who respond in hours, not days

Ready to stop chasing documents?

No credit card required | Explore with demo data