Accelerate Deal Analysis

Flextract swiftly extracts key data points from offering memorandums, including property details, financial summaries, and market information.

This rapid extraction helps investors and lenders quickly size loans or underwrite property financials before issuing Letters of Intent (LOIs), streamlining the early stages of deal evaluation.

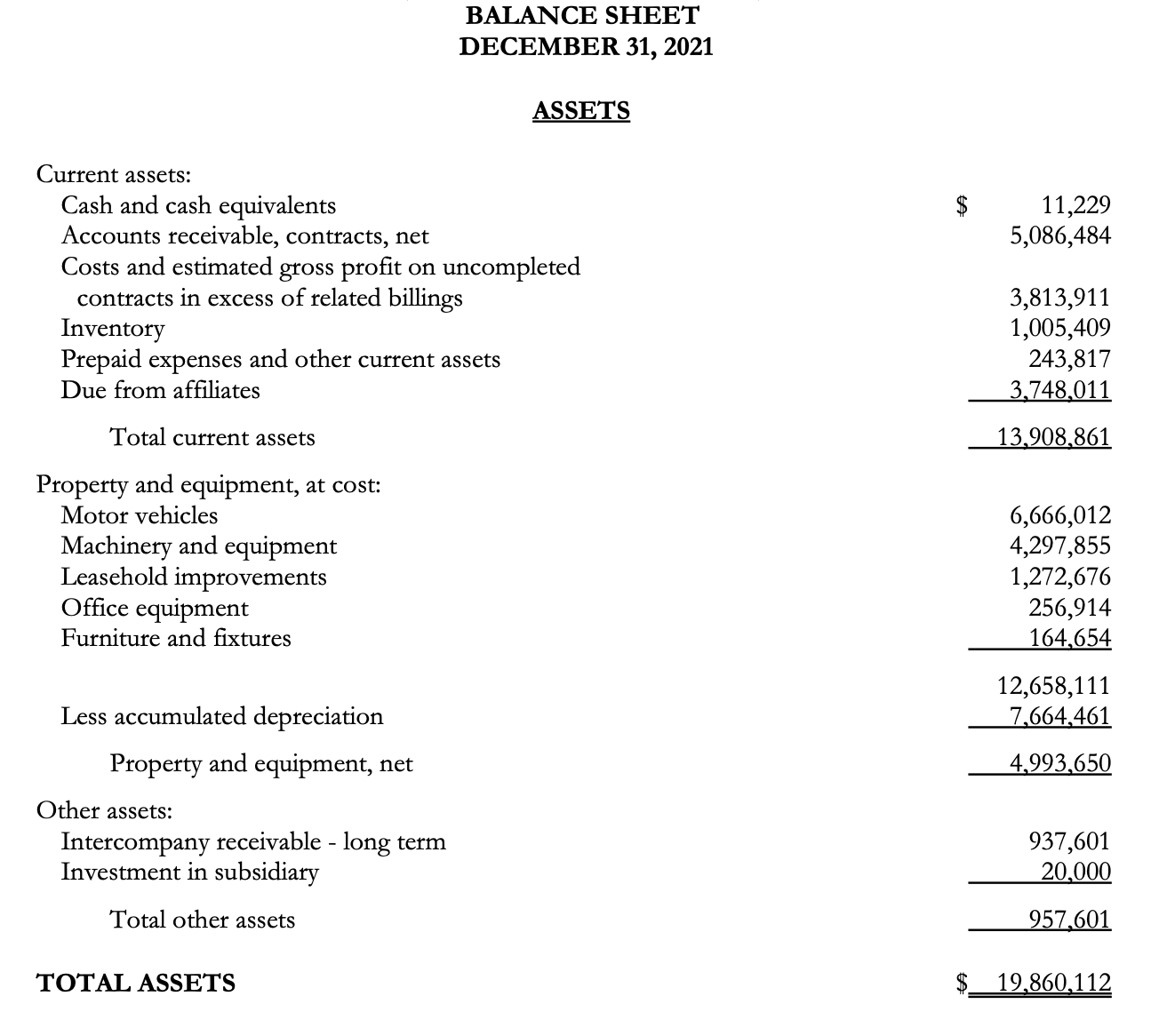

Streamline Borrower Financial Assessment

Flextract efficiently extracts critical financial data from balance sheets, income statements, and cash flow statements.

This enables lenders to swiftly and accurately compute financial ratios and underwrite the borrower's financial condition, facilitating faster loan decisions and more precise risk assessments.

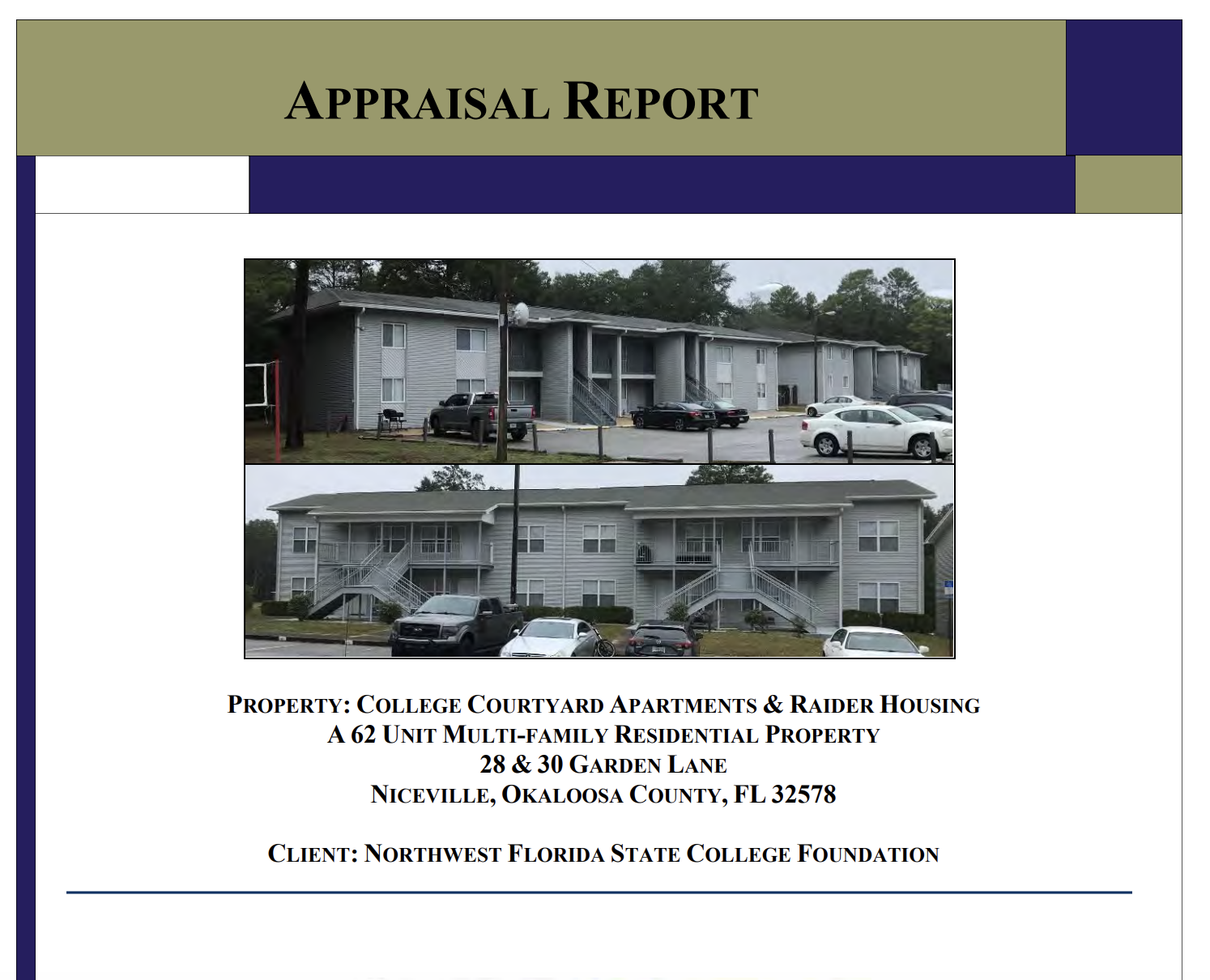

Expedite Due Diligence & Loan Underwriting

Flextract extracts vital information from property appraisals, including valuation figures, comparable sales data, and property condition assessments.

This streamlines the due diligence process and enhances loan underwriting accuracy, allowing for more informed investment and lending decisions.

Optimize Risk Management & Monitoring

Flextract extracts key environmental risk factors, remediation recommendations, and compliance statuses from environmental reports.

This facilitates thorough due diligence and enables ongoing monitoring of environmental concerns, ensuring that investors and lenders stay informed about potential liabilities.

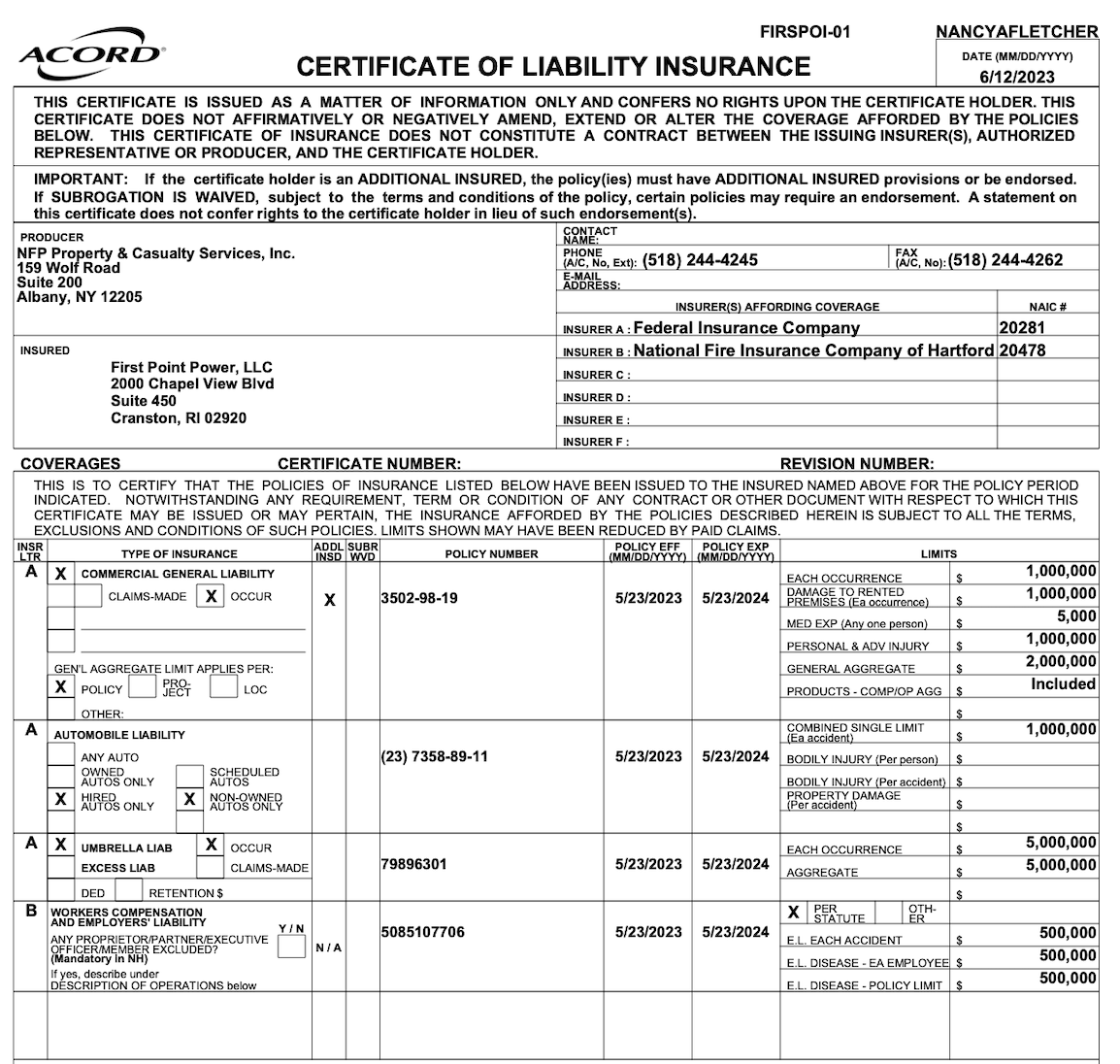

Simplify Compliance Monitoring

By extracting key details such as coverage types, limits, and expiration dates from insurance certificates, Flextract helps lenders effortlessly monitor ongoing compliance with loan terms.

This ensures that borrowers maintain up-to-date insurance coverage, mitigating risks for lenders throughout the loan term.

Tailored Solutions for Your Unique Needs

Flextract goes beyond standard document types. Our flexible system adapts to your specific requirements, ensuring comprehensive data extraction across all your critical documents.

Whether it's specialized industry forms, proprietary reports, or any other document crucial to your workflow, Flextract has you covered.